Every 60 seconds, Amazon processes over $1 million in sales. That’s not just impressive, it’s reshaping how the entire world shops, works, and does business.

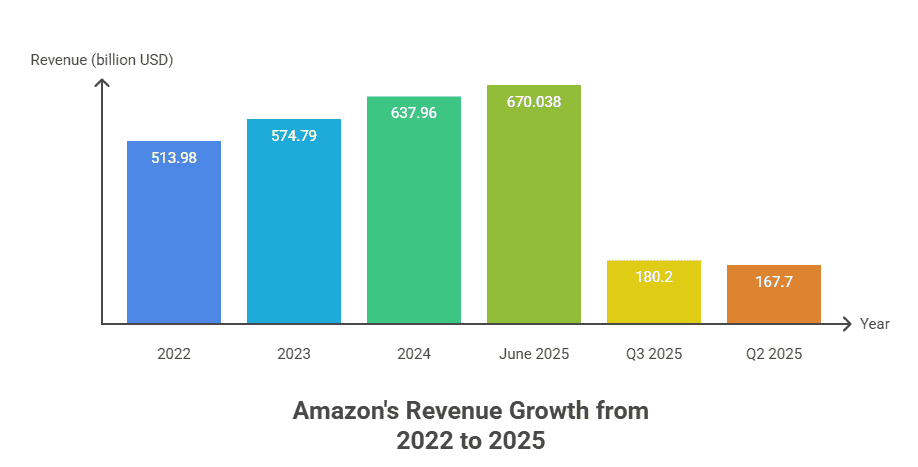

With Q3 2025 revenue hitting $180.2 billion, the second highest in company history, Amazon proves that its growth isn’t slowing down. It’s accelerating.

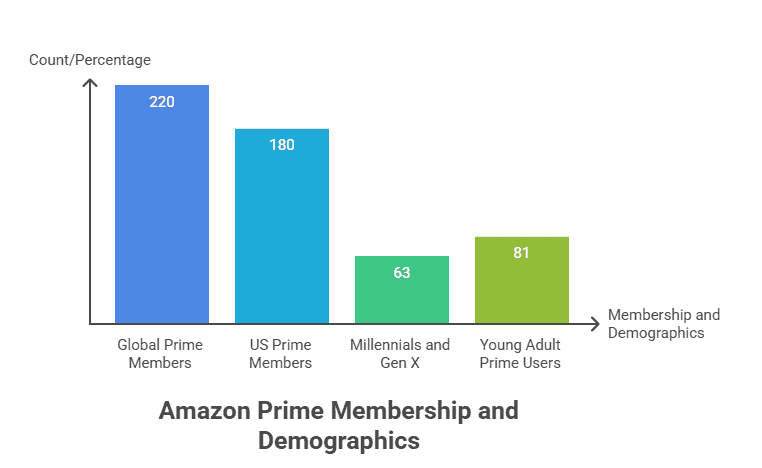

The numbers tell an incredible story. Amazon commands 37.6% of the entire US e-commerce market. They’ve built a loyal army of 220 million Prime members worldwide. But here’s what most people don’t realise: these figures represent just the tip of the iceberg.

This article breaks down the most current Amazon statistics that matter right now. You’ll discover their latest revenue streams, workforce expansion, market dominance across different sectors, and what these numbers mean for businesses, consumers, and competitors in 2025.

Let’s get into the data that shows why Amazon remains the most fascinating company to watch.

What Is Amazon?

Amazon was started as an online bookstore in the basement of its founder, Jeff Bezos. Today the company sells about 380 million products on its marketplace and is popularly called ‘the everything store.

The Amazon marketplace is a two-sided ecommerce platform connecting buyers to third-party sellers. The marketplace provides a platform for buyers and sellers to interact and trade with each other. The buyers get to choose from multiple options available on Amazon, whereas the sellers get to connect with an established base of buyers and sell their products.

Key Amazon Statistics

Here are the numbers that showcase Amazon’s current position in the global marketplace:

- Q3 2025 revenue reached $180.2 billion, marking Amazon’s second-highest quarterly total ever

- Maintains 37.6% of the entire US e-commerce market share

- Employs 1.55 million people globally, including 350,000 corporate employees

- Prime membership base spans 220 million subscribers worldwide, with 180 million in the US (2024)

- Third-party sellers generate 60% of total Amazon sales, with 1.9 million active sellers on the platform

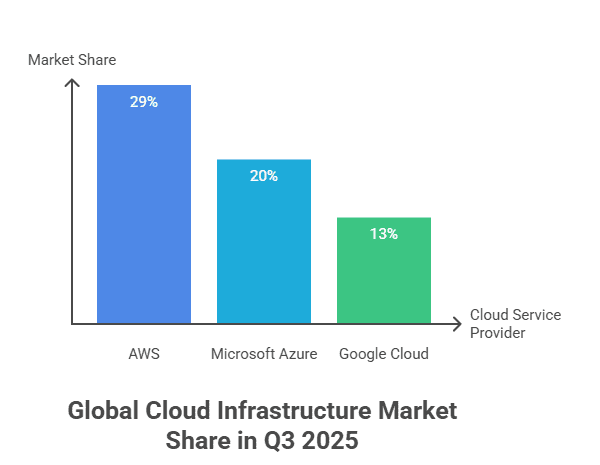

- AWS commands 29% of the global cloud computing market share

- Confirmed 14,000 job cuts as part of corporate restructuring efforts in 2025

- 2024 annual revenue hit $637.96 billion, representing a 10.99% increase from 2023

The revenue growth shows Amazon’s continued dominance, while the workforce adjustments reflect its focus on efficiency in an uncertain economic climate. What’s particularly striking is how third-party sellers now drive the majority of Amazon’s sales, transforming the platform from a retailer into a marketplace ecosystem.

Revenue and Financial Performance

The numbers tell a story of relentless growth. Here’s what Amazon’s recent financial performance looks like:

- Q3 2025 revenue: $180.2 billion

- Q2 2025 revenue: $167.7 billion with a 13.33% year-over-year increase

- International sales: $40.9 billion in Q3 2025 (14% year-over-year growth)

- Twelve-month revenue ending June 2025: $670.038 billion (10.87% year-over-year increase)

- Revenue progression: $513.98 billion (2022), $574.79 billion (2023), $637.96 billion (2024)

What’s striking here isn’t just the size of these numbers, it’s the consistency. Amazon added over $60 billion in revenue from 2022 to 2023, then another $63 billion from 2023 to 2024. That’s like adding an entire Fortune 100 company to their business every single year.

At 14% year-over-year growth, Amazon’s global expansion is outpacing its overall growth rate. This suggests they’re not just maintaining dominance in established markets; they’re actively conquering new ones. With their twelve-month revenue already crossing $670 billion by June 2025, Amazon seems well-positioned to break the $700 billion barrier by year’s end. That would make them one of the first companies in history to hit such a milestone through operational revenue alone.

Global Workforce and Employment

Amazon’s massive workforce spans the globe, but recent strategic decisions reveal how the company is changing its employment landscape for the AI era. Here’s what you need to know about Amazon’s employment numbers:

- Total global workforce: 1.55 million employees

- Corporate employees: 350,000 out of total workforce

- Confirmed 2025 job cuts: 14,000 corporate positions (represents 4% of corporate employees)

- US operations: approximately 950,000 workers across fulfilment centres, offices, and delivery

- Warehouse/fulfilment workers: roughly 1.2 million globally (largest employee segment)

- Strategic focus: layoffs target corporate/technical positions, not frontline fulfilment workers

The scale of Amazon’s workforce is staggering – you’re looking at more people than the entire population of many small countries. But what’s interesting is how Amazon is strategically restructuring this massive human operation. The 14,000 corporate layoffs represent the company’s largest corporate job cuts ever, yet they don’t touch the fulfilment centres where the majority of Amazon’s workers actually operate.

This tells you something important about Amazon’s priorities. While they’re cutting corporate roles in response to AI automation and cost pressures, they’re keeping the warehouse workers who handle the physical logistics that customers depend on. It’s a clear signal that Amazon sees its fulfilment network as its competitive advantage – the part of the business that can’t be easily replaced by AI or competitors.

Prime Membership and Customer Base

Here’s what makes Amazon’s customer loyalty engine so powerful: they’ve turned shopping into a subscription service. And the numbers prove just how well this strategy works.

The scale is staggering:

- Global Prime membership: 220 million Prime members worldwide

- US Prime members: 180 million (82% of global base)

- Demographics: Millennials and Gen X constitute 63% of US Prime households

- Age targeting: 81% of US internet users aged 18-34 have a paid Prime membership

- Primary benefit: 9 out of 10 people get Prime primarily for free shipping

- Additional services: Video streaming, music, gaming, grocery delivery

What’s brilliant about this approach is how it flips traditional retail logic. Instead of competing for each individual purchase, Amazon gets customers to pay upfront for the privilege of shopping with them more often.

That demographic breakdown tells you everything about Amazon’s future. They’ve captured the spending prime of two entire generations. When 81% of young adults are already locked into your ecosystem, you’re not just winning today’s market – you’re securing tomorrow’s.

But here’s the real genius: Prime isn’t just about shipping anymore. Those additional services create multiple touchpoints throughout a customer’s day. You might join for free delivery, but you stay because your kids watch Prime Video, you listen to Prime Music during commutes, and you order groceries through Amazon Fresh.

Each service makes leaving more painful. That’s customer stickiness at its finest – and it’s exactly why Amazon’s revenue keeps climbing year after year.

E-commerce Market Dominance

Amazon’s grip on e-commerce isn’t just about selling products; it’s about creating an entire ecosystem where others do the heavy lifting. Here’s how they’ve built their marketplace empire:

- Amazon holds 37.6% US e-commerce market share in 2025

- Third-party sellers generate over 60% of Amazon sales

- 1.9 million active third-party sellers globally

- 1.1 million active sellers in US (58% of global seller base)

- 86% of Amazon sellers use Fulfilment by Amazon (FBA) services

- 47% of small/medium sellers have surpassed $100,000 in lifetime sales

What’s brilliant about Amazon’s strategy is how they’ve shifted from being just a retailer to being the infrastructure that powers millions of other businesses.

The marketplace model creates multiple revenue streams while reducing Amazon’s risk. When a third-party seller lists a product, Amazon collects fees but doesn’t hold inventory risk. If the product flops, that’s the seller’s problem. If it succeeds, Amazon takes their cut from every transaction.

That 86% FBA adoption rate shows how dependent sellers have become on Amazon’s logistics network. Sellers basically rent Amazon’s fulfilment capabilities, warehouses, and delivery system. It’s like having your own distribution network without the massive infrastructure investment.

The result? Amazon gets paid whether they’re selling their own products or facilitating someone else’s sales. Plus, all that third-party activity generates data about what products work, which Amazon can use for their own private label strategy.

Cloud Computing and AWS Performance

While everyone sees Amazon as the e-commerce giant, the real profit machine runs quietly in the background. AWS isn’t just another business unit; it’s become Amazon’s financial backbone and competitive fortress.

Here’s how AWS dominates the cloud landscape:

- AWS holds 29% of global cloud infrastructure market share in Q3 2025

- Microsoft Azure trails at 20% market share

- Google Cloud captures 13% of the market

- Global cloud infrastructure market expected to exceed $400 billion in 2025

- Amazon committed over $100 billion in capital expenditures for 2025

- The majority of capex focuses on AI and cloud infrastructure, including custom Trainium chips

That nearly 30% market share translates to something massive. What started as Amazon’s internal infrastructure became a business larger than most Fortune 500 companies on its own.

But here’s what makes AWS truly powerful: it’s not just about current dominance. Amazon’s betting big on the future with custom silicon like Trainium chips for AI processing. While competitors buy chips from others, Amazon builds its own. That’s the kind of vertical integration that creates real competitive moats.

The $100 billion capital expenditure commitment isn’t just spending—it’s Amazon doubling down on AI infrastructure when everyone else is scrambling to catch up. When you’re already leading and you’re investing the most, that gap tends to widen.

Market Competition and Future Outlook

Amazon’s dominance doesn’t guarantee smooth sailing ahead. The retail giant faces mounting pressure from multiple fronts, even as it continues expanding into new territories.

Here’s how the competitive landscape is shifting:

- Traditional retailers are fighting back – Walmart and Target have invested billions in their digital platforms and same-day delivery

- Specialised competitors are emerging – Companies like Shopify empower smaller retailers, while Instacart dominates grocery delivery

- International markets remain fragmented – Local players like Alibaba in China and Flipkart in India hold strong positions

- Regulatory scrutiny is intensifying – Antitrust investigations could limit Amazon’s ability to acquire competitors

That’s where Amazon’s investments in AI and automation become critical. The company is betting heavily on machine learning to optimise everything from warehouse operations to personalised recommendations. This tech advantage helps maintain lower costs and faster delivery times.

But here’s the thing – size creates its own challenges. Amazon’s massive logistics network, while impressive, faces increasing pressure to become carbon neutral. The company has committed to net-zero emissions by 2040, requiring significant infrastructure changes.

Looking ahead, Amazon’s growth will likely depend on three key areas: expanding AWS globally, penetrating international retail markets, and maintaining its innovation edge in emerging technologies. The question isn’t whether Amazon will face more competition – it’s how well the company can adapt its massive operation to stay ahead of nimble competitors and changing consumer expectations.

Ravpreet is an avid writer, prone to penning compelling content that hits the right chord. A startup enthusiast, Ravpreet has written content about startups for over three years and helped them succeed. You can also find her cooking, making singing videos, or walking on quiet streets in her free time.